Лекция: Lectures on marketing

Лекция: Lectures on marketing

LECTURE 1: INTRODUCTION TO MARKETING RESEARCH

The American Marketing Association Redefines Marketing Research

The New Definition: Marketing research is the function which links the

consumer, customer, and public to the marketer through

Information:

- Used to identify and define market opportunities and problems

- Generate, refine, and evaluate marketing performance

- Monitor marketing performance

- Improve understanding of marketing as a process

The Role of Marketing Research

-Customer Groups (Consumers, Employees, Shareholders, Suppliers)

-Controllable Marketing Variables (Product, Pricing, Promotion. Distribution)

-Uncontrollable Environmental Factors (Economy, Technology, Laws &

Regulation,Social & Cultural Factors, Political Factors)

-Assessing Information Needs

-Providing Information

-Marketing Decision Making

--Marketing Managers (Market Segmentation, Target Market Selection, Marketing

Programs, Performance & Control

Market Research

-Specifies the information necessary to address these issues

-Manages and implements the data collection process

-Analyzes the results

-Communicates the findings and their implications

Classification of Marketing Research

- Problem Identification Research

--Market potential research

--Market share research

--Market characteristics research

--Sales analysis research

--Forecasting research

--Business trends research

- Problem Solving Research

--Segmentation Research

--Product Research

--Promotion Research

--Distribution Research

Problem Solving Research

-Segmentation Research

--Determine the basis of segmentation

--Establish market potential and responsiveness for various segments

--Select target markets

--Create lifestyle profiles: demography, media, and product image

characteristics

-Product Research

--Test concept

--Determine optimal product design

--Package tests

--Product modification

--Brand positioning and repositioning

--Test marketing

--Control score tests

- Pricing research

--Importance of price in brand selection

--Pricing policies

--Product line pricing

--Price elasticity of demand

--Initiating and responding to price changes

- Promotional research

--Optimal promotional budget

--Sales promotion relationship

--Optimal promotional mix

--Copy decisions

--Media decisions

--Creative advertising testing

--Claim substantiation

--Evaluation of advertising effectiveness

-Distribution Research

Determine.

--Types of distribution

--Attitudes of Channel members

--Intensity of wholesale & resale coverage

--Channel margins

--Location of retail and wholesale outlets

Management Information Systems versus Decision Support Systems

MIS

-Structured Problems

-Use of Reports

-Rigid Structure

-Information Displaying Restricted

-Can Improve Decision Making by Clarifying Data

DSS

-Unstructured Problems

-Use of Models

-User Friendly Interaction

-Adaptability

-Can Improve Decision Making by Using “What if” Analysis

Marketing information system (MIS)

-MIS – is a system to generate, store, and disseminate information to

marketing managers (internal Data, -External Data)

-Recurrent info – info provided by a MIS on a periodic basis

-Monitoring info – info derived from regular scanning of selected sources

-Requested info – info developed in response to a specific request by a

marketing manager

Marketing Research Supplier and Services

RESARCH SUPPLIERS

INTERNAL

-FULL SERVICE (Syndicate Services, Standardized Services, Customized

Services, Internet Services)

EXTERNAL

-LIMITED SERVICE (Field Services, Coding and Data Entry Services, Analytical

Services, Data Analysis Services, Branded Products and Services)

Organization of Marketing Research at Oscar Mayer

-Brand Research

--Conducts Primary & Secondary Research

--Serves As Marketing Consultants

--Analyzes Market Trends

--Advances the State of the Art in Marketing Research

-Marketing Systems and Analytics (MSA)

--Performs Sales Analysis Based on Shipment & Store Scanner Data

--Supports Computer End Users within Marketing Department

--Serves as Source of Marketing Information

Top market research firms on the Russian market

-Comcon – 2 (main information product – R-TGI Russian Target group index –

36000 respondents from-13 regions and cities of Russia) – Panel research

-Gallup media research

-AC Nielsen

-ROMIR

-GFK-Russia

-A/R/M/I-marketing

-MAGRAM market research

-Ipsos-F-squared research

Selected Marketing Research Career Descriptions

Vice-President of Marketing Research: The senior position in marketing

research. The vice president (VP) is responsible for the entire marketing

research operation of the company and serves on the top management team. This

person sets the objectives and goals of the marketing research department.

Research Director: Also a senior position. The research director has the

general responsibility for the development and execution of all the marketing

research projects.

Assistant Director of Research: Serves as an administrative assistant to

the director and supervises some of the other marketing research staff members.

(Senior) Project Manager: Has overall responsibility for design,

implementation, and management of research projects.

Statistician/Data Processing Specialist: Serves as an expert on theory

and application of statistical techniques. Responsibilities include

experimental design, data processing, and analysis.

Vice President of Marketing Research

-Part of company’s top management team

-Directs company’s entire market research operation

-Sets the goals & objectives of the marketing research department

Research Director

-Also part of senior management

-Heads the development and execution of all research projects

Assistant Director of Research

-administrative assistant to director

-supervises research staff members

Senior Project Manager

-Responsible for design, implementation, & research projects

Senior Analyst

-Participates in the development of projects

-Carries out execution of assigned projects

-Coordinates the efforts of analyst, junior analyst, & other personnel

development of research design and data collection

-Prepares final report

Analyst

-Handles details in execution of project

-Designs & pretests questionnaires

-Conducts

-Preliminary analysis of data

Junior Analyst

-Secondary data analysis

-Edits and codes questionnaires

-Conducts preliminary analysis of data

Statistician/Data Processing

-Serves as expert on theory and application on statistical techniques

-Oversees experimental design, data processing, and analysis

Field Work Director

-Handles selection, training, supervision, and evaluation of interviewers and

field workers

Marketing Research at Marriott Corporation

Marriott functions in three main areas: lodging (Marriott Hotels and Resorts,

Marriott Suites, Residence Inns, Courtyard Hotels, and Fairfield Inns),

contract services (Marriott Business Food and Services, Education, Health-

Care, In-Flight Services, and Host International, Inc.) and restaurants

(family restaurants, Travel Plazas, and Hot Shops). It is probably best

known, however, for its lodging operations.

Marketing research at Marriott is done at the corporate level through the

Corporate Marketing Services (CMS). CMS’s goals include providing the

management of the different areas of Marriott with the information they need

to better understand the market and the customer.

CMS conducts many different types of research. They use quantitative and

qualitative research approaches such as telephone and mail surveys, focus

groups, and customer intercept to gain more information on market

segmentation and sizing, product testing, price sensitivity of consumers,

consumer satisfaction, and the like.

The process of research at Marriott is a simple stepwise progression. The

first step is to better define the problem to be addressed and the objectives

of the client unit and to develop an approach to the problem. The next step

is to formulate a research design and design the study. CMS must decide

whether to conduct its own research or buy it from an outside organization.

If the latter option is chosen, CMS must decide whether or not to use

multiple firms. Once a decision is made, the research is carried out by

collecting and analyzing the data. Then, CMS presents the study findings. The

final step in the research process is to keep a constant dialogue between the

client and the CMS. During this stage, CMS may help explain the implications

of the research findings or may make suggestions for future actions.

Marketing Research Associations Online

Domestic

AAPOR: American Association for Public Opinion Research (www.aapor.org)

AMA: American Marketing Association (www.marketingpower.org)

ARF: The Advertising Research Foundation (www.amic.com/arf)

CASRO: The Council of American Survey Research Organizations (www.casro.org)

MRA: Marketing Research Association (www.mra-net.org)

QRCA: Qualitative Research Consultants Association (www.qrca.org)

RIC: Research Industry Coalition (www.research industry.org)

International

ESOMAR: European Society for Opinion and Marketing Research (www.esomar.nl)

MRS: The Market Research Society (UK) (www.marketresearch.org.uk)

MRSA: The Market Research Society of Australia (www.mrsa.com.au)

PMRS: The Professional Marketing Research Society (Canada) (www.pmrs-aprm.com)

In Russia: Russian Marketing association ( www.rma.ru)

Gildia of marketers – professional marketers organization

Steps in decision making process

-Establish objectives

-Determine performance/potential

-Select problem/opportunity to pursue

-Develop alternatives

-Choose best alternative

-Implement alternative

-Modify as necessary

LECTURE 2: DEFINING THE MARKETING RESEARCH PROBLEM AND DEVELOPING AN APPROACH

Marketing research process

Identifying a management problem or opportunity; translating that into a

research problem; and collecting, analyzing, and reporting the results

Management problem

Determining the best course of action to take to maximize the organization’s

objectives

Marketing research design

The specification of procedures for collecting and analyzing data to help

identify or react to a problem or opportunity

Types of research design

-Exploratory research:attempts to discover the general nature of

the problem and the variables that relate to it

-Descriptive research: focuses on the accurate description of the

variables in the research model

-Causal research: attempts to specify the nature of the functional

relationship between two or more variables in the problem model

Steps in the research design process

-Define the research problem

-Estimate the value of the info to be provided by the research

-Select the data collection methods

-Select the measurement techniques

- Select the sample

-Select the analytical approach

-Evaluate the ethics of the research

-Specify the time and financial cost

-Prepare the research report

Factors to be Considered in the Environmental Context of the Problem

-past information and forecasts

-resources and constraints

-objectives

-buyer behavior

-legal environment

-economic environment

-marketing and technological skills

Proper Definition of the Research Problem

Broad Statement--->Specific Components

The Role of Theory in Applied Marketing Research

1. Conceptualizing and identifying key variables- Provides a conceptual

foundation and understanding of the basic processes underlying the problem

situation. These processes will suggest key dependent and independent

variables.

2. Operationalizing key variables- Theoretical constructs (variables)

can suggest independent and dependent variables naturally occurring in the real

world.

3. Selecting a research design- Causal or associative relationships

suggested by the theory may indicate whether a causal or descriptive design

should be adopted.

4. Selecting a sample- The theoretical framework may be useful in

defining the population and suggesting variables for qualifying respondents,

imposing quotas, or stratifying the population (see Chap. 11).

5. Analyzing and interpreting data- The theoretical framework (and the

models, research questions and hypotheses based on it) guide the selection of a

data analysis strategy and the interpretation of results (see Chap. 14).

6. Integrating findings- The findings obtained in the research project

can be interpreted in the light of previous research and integrated with the

existing body of knowledge.

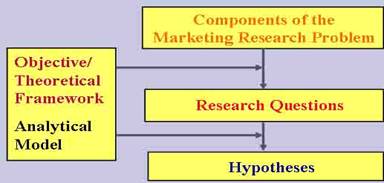

Development of Research Questions and Hypotheses

At United, Food is Uniting the Airline With Travelers

United Airlines, as other major airlines, had to deal with passenger loyalty

(management decision problem: how to attract more and more loyal passengers).

The broad marketing research problem was to identify the factors that

influence loyalty of airline travelers.

The basic answer is to improve service. Exploratory research, theoretical

framework, and empirical evidence revealed that the consumers’ choice of an

airline is influenced by: safety, price of the ticket, frequent-flyer

program, convenience of scheduling, and brand name.

A graphical model stipulated that consumers evaluate competing airlines

based on factors of the choice criteria to select a preferred airline. The

problem was that major airlines were quite similar on these factors. Indeed,

"airlines offer the same schedules, the same service, and the same fares.”

Consequently, United Airlines had to find a way to differentiate itself. Food

turned out to be the solution.

Secondary data, like the J. D Power & Associates' survey on "current and

future trends in airline food industry", indicated that "food service is a

major contributor to customers’ loyalty". This survey also emphasized the

importance of food brands.

The airline's Marketrak survey told United Airlines that "customers wanted

more varied and up-to date food.”

The following research questions and hypotheses may be posed.

RQ1 How important is food for airline customers?

H1: Food is an important factor for airline travelers

H2: Travelers value branded food

H3: Travelers prefer larger food portions, but with consistent quality

H4: Travelers prefer exotic food

Characteristics which influence the research design included the

identification of competing airlines (Delta, American, Aeroflot etc.),

factors of the choice criteria (already identified), measurement of airline

travel and loyalty.

This kind of research helped United Airlines to define their marketing

research problem, and develop the approach. Focus groups and surveys were

conducted to check customers' perceptions of food in United Airlines'

aircraft. The results provided support for all the hypotheses (H1 to H4).

United Airlines then made a few changes: new "culinary menus," larger

portions of food, new coffee and branded products (e.g., Godiva chocolates).

This resulted in better service, increasing customer satisfaction and

fostering loyalty.

LECTURE 3: RESEARCH PROCESS AND RESEARCH DESIGN, RESEARCH BRIEF AND

RESEARCH PROPOSAL

Classification of Marketing Research Designs

-Exploratory Research Design

-Conclusive Research Design

-- Descriptive Research

---Cross-Sectional Design

----Single Cross-Sectional Design

----Multiple Cross-Sectional Design

---Longitudinal Design

-- Casual Research

Relative Advantages and Disadvantages of Longitudinal and Cross-Sectional

Designs

Cross-Sectional Design

ADV: Representative Sampling, Response bias

Longitudinal Design

ADV: Detecting Change, Large amount of data collection, Accuracy

Cross-Sectional Data May Not Show Change

Longitudinal Data May Show Substantial Change

Difference between Exploratory and Conclusive Research

Exploratory

Objective: To provide insights and understanding.

Characteristics: Information needed is defined only loosely.

Research process is flexible and unstructured. Sample is small and

non-representative. Analysis of primary data is qualitative

Findings/Results: Tentative

Outcome: Generally followed by further exploratory or conclusive research.

Conclusive

Objective: To test specific hypotheses and examine relationships.

Characteristics: Information needed is clearly defined. Research

process is formal and structured. Sample is large and representative. Data

analysis is quantitative.

Findings/Results: Conclusive

Outcome: Findings used as input into decision making.

Comparison of Basic Research Designs

Exploratory:

Objective: Discovery of ideas and insights

Characteristics: Flexible, versatile. Often the front end of total

research design

Methods: Expert surveys, Pilot surveys, Secondary data, Qualitative research

Descriptive:

Objective: Describe market characteristics or functions

Characteristics: Marked by the prior formulation of specific

hypotheses. Preplanned and structured design

Methods: Secondary data, Surveys, Panels, Observation and other data

Causal

Objective: Determine cause and effect relationships

Characteristics: Manipulation of one or more independent

variables. Control of other mediating variables

Methods: Experiments

MARKET RESEARCH

Problem-How to find the answer

What is the need, problem? Observation studies, habits and attitudes, market

structure studies

What benefit and reason why?

How good is the idea / concept? Innocheck or Falcon

How good is the product? Product Test

How good is the advertising? PreView

How functional is the packaging? In Use Test

How good is the packaging design? Pack Test

How viable is the mix (Product, Pack, Adv, Price)? Simulated Test Market

How good is the distribution? Retail Index. Distribution Check

Were our pricing objectives met? Retail Index. Distribution check

How much shelf space did we get? Retail Index. Store Checks, Brand Tracking

How effective is my advertising campaign? Retail Index, Consumer Panel

How well are we doing? Brand Tracking

THE RESEARCH BRIEF (“A PROBLEM WELL DEFINED IS A PROBLEM HALF SOLVED”)

THE WHEEL OF RESEARCH

-Identify problem

-Write Brief

-Write proposal

-Do fieldwork

-Do DP

-Analysis

-Present results /Report

-Take action

-Monitor action

Main functions:

To give a ...COMPLETE AND CLEAR DESCRIPTION of the.

-Perceived problem

-Markets involved

-Decisions likely to be taken

COMMUNICATION

MARKET RESEARCH IS AS GOOD AS ITS BRIEF

- Written (never only verbal)

-Available in advance

-Personal discussion with agency, MRM and Brand Office

CONTENT

-Background

-Objectives

-Actions standards

-Target market

-Materials

-Timing

RELEVANT APPENDICES : BRAND POSITIONING / PERSONALITY /

ADVERTISING PACKAGING BRIEF

ATTRIBUTES/DATA FORMAT etc.

BACKGROUND

Essential information required for understanding the need for research

-Resume of the status quo

-Description of the problem and reasons for the problem (CORRECTLY IDENTIFY

THE PROBLEM)

OBJECTIVES

Items of information required in order to solve the marketing problem

(FOCUSED / SPECIFIC / KEY)

THE PROPOSAL

TECHNIQUE / TEST DESIGN

-Sampling method (venue, home, postal, telephone, etc.)

-Substitution

-Weighting

-Use of special equipment / methods

-Recalls

SAMPLE

-Size of sample / sub-samples

-Justification of sample size

-Universe covered / justification

-How respondents qualify to be interviewed

-Validity / reliability of sample

-Clear breakdown by sub-sample

-Relevance to market / brand positioning

-Relevance to problem

DATA ANALYSIS

-Exact breakdown for each question

-Justification for these breakdowns

-Special analysis (mapping / modeling, etc.)

-Experience with this type of analysis

QUALITY CONTROL PROCEDURES

-Both field and DR procedures

-Numbers / types of checks done

-Who involved / experience

TIMING

Detailed time plan from day of acceptance of proposal must include estimated

report / presentation date. Where timing is unusual, should justify.

REQUIREMENTS FROM CLIENT

-Detail all products, advertising material, etc. needed, including date by

when required and venue to be delivered

-Include all details of client participation

REPORTING

-Way in which data will be reported / presented

-Details of special graphs / charts

-Number of report copies will provide

-What report will contain

COST

Full details on cost and what is included, broken down by stage (if relevant)

CONTRACTUAL CONDITIONS

-Method of billing

-Responsibilities and limitations

-Publishing data

-Codes which are adhered to

A GOOD PROPOSAL MUST CONTAIN

-Background / problem definition

-Objectives of project

-Action standards

-Sample

-Technique / test design

-Data analysis

-Quality control measures

-Requirements from client

-Timing

-Reporting / presentation format

-Cost

-Contractual conditions

Potential Sources of Error in Research Designs

Total Error

-Random Sampling Error

-Non-sampling Error

-- Response Error

---Researcher Error

----Surrogate Information Error

----Measurement Error

----Population Definition Error

----Sampling Frame Error

----Data Analysis Error

---Interviewer Errors

----Respondent Selection Error

----Questioning Error

----Recording Error

----Cheating Error

---Respondent Error

----Inability Error

----Unwillingness Error

--Non-response Error

Citicorp Banks on Exploratory, Descriptive, and Causal Research

Marketing Research at Citicorp is typical in that it is used to measure

consumer awareness of products, monitor their satisfaction and attitudes

associated with the product, track product usage and diagnose problems as

they occur. To accomplish these tasks Citicorp makes extensive use of

exploratory, descriptive, and causal research. Often it is advantageous to

offer special financial packages to specific groups of customers. In this

case, a financial package is being designed for senior citizens.

The following seven step process was taken by marketing research to help in

the design.

1) A taskforce was created to better define the market parameters to include

all the needs of the many Citicorp branches. A final decision was made to

include Americans 55 years of age or older, retired and in the upper half of

the financial strata of that market.

2) Exploratory research in the form of secondary data analysis of the mature

or older market was then performed and a study of competitive products was

conducted. Exploratory qualitative research involving focus groups was also

carried out in order to determine the needs and desires of the market and the

level of satisfaction with the current products.

In the case of senior citizens, a great deal of diversity was found in the

market. This was determined to be due to such factors as affluence, relative

age, and the absence or presence of a spouse.

3) The next stage of research was brainstorming. This involved the formation

of many different financial packages aimed for the target market. In this

case, a total of 10 ideas were generated.

4) The feasibility of the 10 ideas generated in step 3 was then tested. The

ideas were tested on the basis of whether they were possible in relation to

the business. The following list of questions was used as a series of

hurdles that the ideas had to pass to continue on to the next step.

-Can the idea be explained in a manner that the target market will easily

understand it?

-Does the idea fit into the overall strategy of Citicorp?

-Is there an available description of a specific target market for the

proposed product?

-Does the research conducted so far indicate a potential match for target

market needs and is the idea perceived to have appeal to this market?

-Is there a feasible outline of the tactics and strategies for implementing

the program?

-Have the financial impact and cost of the program been thoroughly evaluated

and determined to be in line with company practices?

In this study, only one idea generated from the brainstorming session made it

past all the listed hurdles and on to step 5.

5) A creative work-plan was then generated. This plan was to emphasize the

competitive advantage of the proposed product as well as better delineate the

specific features of the product.

6) The previous exploratory research was now followed up with descriptive

research in the form of mall intercept surveys of people in the target market

range. The survey showed that the list of special features was too long and

it was decided to drop the features more commonly offered by competitors.

7) Finally, the product was test marketed in six of the Citicorp branches

within the target market. Test marketing is a form of causal research.

Given successful test marketing results, the product is introduced

nationally.

The Greenfield of Online Research

Greenfield Online Research Center, Inc. (http://www.greenfieldonline.com),

based in Westport, Connecticut, is a subsidiary of the Greenfield Consulting

Group. The Online Research Center conducts focus groups, surveys, and polls

over the Internet. The company has built up a “panel” of close to 200,000

Internet users, from which it draws survey samples. The samples may be used

for descriptive research designs like single or multiple cross sectional

designs, as well as longitudinal designs. Causal designs can also be

implemented. Respondents may also be chosen from the registered Internet

users.

Internet users wishing to take part in surveys and other projects begin by

registering online at the company’s Web site. The registration consists of a

“sign-up survey” that asks for e-mail address, type of computer used,

personal interests and information about the respondent’s household. Once an

Internet user is registered, Greenfield Online matches the user with research

studies that are well-suited to his or her interests.

Incentives to take part in focus groups or special surveys are offered by the

companies whose products or services are being researched. This incentive is

cash or valuable prizes. Incentives are also offered to Internet users to

encourage them to register with Greenfield’s Internet panel. New registrants

automatically qualify for prizes that are awarded in monthly drawings.

LECTURE 4: EXPLORATORY RESEARCH DESIGN: SECONDARY DATA

Comparison of Primary & Secondary Data

Primary Data Secondary Data

Collection purpose for the problem at hand

for other problems

Collection process Very involved

Rapid & easy

Collection cost High

Relatively low

Collection time Long

Short

Criteria for Evaluating Secondary Data

Criteria | Issues | Remarks | Specifications & methodology Error & Accuracy Currency Objective Nature Dependability | Data collection method, response rate, quality & analysis of data, sampling technique & size, questionnaire design, field work. Examine errors in approach, research design, sampling, data collection & analysis, & reporting. Time lag between collection & publication, frequency of updates. Why were the data collected? Definition of key variables, units of measurement, categories used, relationships examined. Expertise, credibility, reputation, trustworthiness of the source. | Data should be reliable, valid, & generalizable to the problem. Assess accuracy by comparing data from different sources. Census data are updated by syndicated firms. The objective determines the relevance of data. Reconfigure the data to increase their usefulness. Data should be obtained from an original source. |

Classification of Secondary Data

-Internal

--Ready to Use

--Requires Further Processing

-External

--Published Materials

--Computerized Databases

--Syndicated Services

Type of Individual/Household Level Data Available from Syndicated Firms

I. Demographic Data

-Identification (name, address, telephone)

-Sex

-Marital status

-Names of family members

-Age (including ages of family members)

-Income

-Occupation

-Number of children present

-Home ownership

-Length of residence

-Number and make of cars owned

II. Psychographic Lifestyle Data

-Interest in golf

-Interest in snow skiing

-Interest in book reading

-Interest in running

-Interest in bicycling

-Interest in pets

-Interest in fishing

-Interest in electronics

-Interest in cable television

There are also firms such as Business Information which collect demographic

data on businesses.

Classification of Published Secondary Sources

-General Business Sources

--Guides

--Directories

--Indexes

--Statistical Data

-Government Sources

--Census Data

--Other Government Publications

Classification of Computerized Databases

-On-Line

-Internet

-Off-Line

Databases:

-Bibliographic Databases

-Numeric Databases

-Full-Text Databases

-Directory Databases

-Special-Purpose Databases

Classification of Syndicated Services

Unit of Measurement

-Households/Consumers

--Surveys

---Psychographic & Lifestyles

---General

---Advertising Evaluation

--Mail Diary Panels

---Purchase

---Media

--Electronic scanner services

---Volume Tracking Data

---Scanner Diary Panels

---Scanner Diary Panels with Cable TV

-Institutions

--Retailers

---Audits

--Wholesalers

---Audits

--Industrial firms

---Direct Inquiries

---Clipping Services

---Corporate Reports

Overview of Syndicated Services

The New York Times on the Web: A New Way to Target Consumers

The New York Times Electronic Media Company offers The New York Times on the

Web database information to advertisers in a manner that enables firms to

leverage the site’s 2 million registrants. The database contains demographic

information, such as age, gender, income, and zip code, that ties to an e-

mail address for each of the members. This new database marketing system can

identify and customize user groups, target web messages to specific segments

of the population, and adjust the message based on audience reaction. It can

also increase targeting opportunities through third-party data or additional

information supplied by the user.

For example, the database enables an automobile firm to emphasize safety to

older customers, luxury to affluent ones, and roominess to families. The

system is set up so that near real-time data can be received from the web

that indicates how well ads are performing relative to age, gender, and

income characteristics. Thus, this system allows a firm to maintain up-to-

date information on audiences in order to position its products effectively.

Classification of International Sources

International Secondary Data

-Domestic Organizations

--Government Sources

--Nongovernmental Sources

-International Organizations in Russia

-Organizations in Foreign Countries

--Governments

--International Organizations

--Trade Associations

LECTURE 6: DESCRIPTIVE RESEARCH DESIGN SURVEY & OBSERVATION

Survey Research is in the Cards for DEC

Digital Equipment Corporation (DEC) has made a conscious effort in the past

years to shift from a product-driven focus to a more market-and consumer-

driven focus. The product focus is not unusual in companies manufacturing

hi-tech products. There is a serious need for market research in these hi-

tech companies as they direct their products to the market. Still, market

research in this arena is difficult. It is complicated by the rapid change of

technology as well as the sheer size of the application market. Often the

technology will be employed in many different industries.

This holds true for the computer market where DEC is a key player. Computers

are bought by individuals in every walk of life as well as by businesses in

every market imaginable. The breadth of the market makes useful market

research a formidable task. This task is being undertaken at DEC in their

Corporate Marketing Services (CMS) Division.

Digital’s Corporate Marketing Services Division has been a core element in

the company’s transition to a market-driven strategy.”

CMS is coordinating the company’s strategy to redefine their product from

simply computers to a broader view of the business solutions. The CMS has

employed many research techniques to gain a better understanding of the

“business solutions” market. Both primary and secondary data are collected.

Primary data are obtained through the use of phone and mail surveys as well

as seminars and focus groups. Phone surveys have been used to define

customer needs better and to direct products to the customers better. Mail

surveys have been used to study customer purchasing habits as well as future

purchasing plans. Seminars are held to gain feedback on the long-term

production plans at DEC. Finally, focus groups are used to determine whether

the chosen strategy is good and one that will effectively manage and use the

market’s potential. Without CMS and marketing research, DEC would be facing the

unknowns of their technology as well as the market. This combination of

obstacles would have made the transition from a product-focused to a market-

and consumer-focused company an impossibility.

Classification of Survey Methods

- Telephone

--Traditional Telephone

--Computer-Assisted Telephone Interviewing

- Personal

--In-Home

--Mall Intercept

--Computer-Assisted Personal Interviewing

- Mail

--Mail Interview

--Mail Panel

- Electronic

--E-mail

--Internet

Some Decisions Related to the Mail Interview Package

Outgoing Envelope

Outgoing envelope: size, color, return address

Postage Method of addressing

Cover Letter

Sponsorship Type of appeal Postscript

Personalization Signature

Questionnaire

Length Size Layout Format

Content Reproduction Color Respondent anonymity

Return Envelope

Type of envelope Postage

Incentives

Monetary versus non-monetary. Prepaid versus promised amount.

Comparative Evaluation of Survey Methods

Criteria Phone In-home

Mall- CAPI Mail Mail E-mail

Internet

CATI Interview Intercept surveys panels

Random Digit Directory Designs

Adding a Constant to the Last Digit

An integer between 1 and 9 is added to the telephone number selected from the

directory. In plus-one sampling the number added to the last digit is

1.Number selected from directory: 237-12-03 (exchange-block). Add one to the

last digit to form 237-12-04. This is the number to be included in the

sample.

Randomizing the r Last Digits

Replace the r (r = 2, 3, or 4) last digits with an equal number of randomly

selected digits. Number selected from directory: 237-10-23. Replace the last

four digits of the block with randomly selected numbers 5, 2, 8, and 6 to

form 237-15-31.

Two-Stage Procedure

The first stage consists of selecting an exchange and telephone number from

the directory. In the second stage, the last three digits of the selected

number are replaced with a three-digit random number between 000 and 999.

Cluster 1

Selected exchange: 636

Selected number: 636-3230

Replace the last three digits (230) with randomly selected 389 to form 636-

3389. Repeat this process until the desired number of telephone numbers from

this cluster is obtained.

Non-response errors

Contacting Respondents (call-backs)

Motivating respondents:

-Prenotification (by letter is a cost effective method of increasing response

rate)

-Type of postage

-The length of questionnaire

-Promised monetary incentives

-Promises of anonymity

Classification of Observation Methods

-Personal Observation

-Mechanical Observation

-Audit

-Content Analysis

-Trace Analysis

Observation – a data collection technique in which the situation of

interest is watched according to prespecified rules based on a stated objective

Building Accord According to Personal Observation

Honda Motor Co. had a lot of complaints on their sporty, restyled Accord (not

big enough for U.S. drivers, not stylish enough for the Japanese drivers).

Being afraid to lose its market, Honda sent teams to visit U.S. families and

observe how the Americans used their Honda Accords. By personal observation,

the teams found out that the Americans like lots of compartments for storing

maps and change. The teams also actually took U.S. road trips in Accord and

in Ford Taurus and Toyota Camry as its rivals in midsize cars. The results of

this observation study were used to design a new 1998 Accord for U.S.

drivers which has 101.7 cubic feet for passenger space compared to 101.5

cubic feet for Ford Taurus and 97.9 cubic feet for Toyota Camry. Moreover,

Accord also delivered higher customer value by cutting the price. With these

changes, Honda executives are expecting to increase U.S. sales to a total of

1 million units by the year 2000.

Using the results of personal observation studies, Honda customizes the

Accord to world markets. U.S. Accord is designed as a family car by

providing extra headroom and a roomy interior to keep up with the demands of

its aging baby-boomers customers, while Japanese Accord is designed as a

compact, sporty car loaded with high-tech gizmos aimed at young

professionals. It is also smaller to adjust to narrower roads in Japan.

Honda also paid attention to its European market. The 1998 Accord for

European version was a short, narrow body customized to tiny streets in

Europe but not losing its stiff and sporty ride aimed at the Old World

drivers.

Comparative Evaluation of Observation Methods

Criteria | Personal Observation | Mechanical Observation | Audit Analysis | Content Analysis | Trace Analysis | Degree of structure Degree of disguise Ability to observe in natural setting Observation bias Analysis Bias General remarks | Low Medium High High High Most flexible | Low to high Low to high Low to high Low Low to Medium Can be intrusive | High Low High Low Low Expensive | High High Medium Medium Low Limited to communications | Medium High Low Medium Medium Method of last resort |

Comparative Evaluation of Survey Methods for International Marketing Research

| Criteria | Telephone | Personal | Mail | Electronic | High sample control Difficulty in locating respondents at home Inaccessibility of homes Unavailability of a large pool of trained interviewers Large population in rural areas Unavailability of maps Unavailability of current telephone directory Unavailability of mailing lists Low penetration of telephones Lack of an efficient postal system Low level of literacy Face-to-face communication culture Poor access to comps. & Internet | + + + + - + - + - + - - + | + - - - + - + + + + + + + | - + + + - + - - + - - - ? | - + + + - + + + - + - - - |

LECTURE 7: QUESTIONNAIRE DESIGN

Youth Research Achieves Questionnaire Objectives

Toy-Opinion Research (YR) of Saint-Petersburg, conducts an omnibus survey of

children every quarter. Typically, YR interviews 150 boys and girls between

ages 6 and 8, along with 150 boys and girls between ages 9 and 12.

Toy-Opinion uses mall intercepts of mothers to recruit for its one-on-one

interviews, which last eight minutes!. The study obtains children’s

views on favorite snack foods, television shows, commercials, radio, magazines,

buzzwords, and movies.

Toy-Opinion intentionally keeps its questionnaire to eight minutes

because of attention span limits of children. President Ivan Virlov

notes that some clients attempt to meet all their research objectives with one

study, instead of surveying, fine-tuning objectives, and re-surveying. In

doing so, these clients overlook attention limits of young respondents when

developing questionnaires.

“The questionnaires keep going through the approval process and people keep

adding questions, ‘Well let’s ask this question, let’s add that question, and

why don’t we talk about this also,” Virlov said. “And so you end up keeping

children 25 minutes in a central location study and they get kind of itchy.”

The response error increases and the quality of data suffers.

Virlov notes other lessons from interviewing children. When asking

questions, interviewers should define the context to which the questions

refers. “It involves getting them to focus on things, putting them in a

situation so that they can identify with it,” Virlov said. “For example,

when asking about their radio listening habits we said, ‘What about when you’re

in Mom’s car, do you listen to radio?’ rather than, ‘How often do you listen to

radio? More than once a day, once a day, more than once a week?’ Those are kind

of big questions for little children.”

Questionnaires designed by Toy-Opinion to obtain children views on favorite

snack foods, television shows, commercials, radio, magazines, buzzwords, and

movies attempt to minimize response error.

Questionnaire Design Process

-Specify the Information Needed

-Specify the Type of Interviewing Method

-Determine the Content of Individual Questions

-Design the Question to Overcome the Respondent’s Inability and Unwillingness

to Answer

-Decide the Question Structure

-Determine the Question Wording

-Arrange the Questions in Proper Order

-Identify the Form and Layout

-Reproduce the Questionnaire

-Eliminate Bugs by Pre-testing

Questionnaire Design Checklist

Step 1 Specify the Information Needed

1. Ensure that the information obtained fully addresses all the сcomponents

of the problem. Review components of the problem and the approach,

particularly the research questions, hypotheses, and characteristics that

influence the research design.

2. Prepare a set of dummy tables.

3. Have a clear idea of the target population.

Step 2 Type of Interviewing Method

1. Review the type of interviewing method determined based on considerations,

discussed on the last lecture

Step 3 Individual Question Content

1. Is the question necessary?

2. Are several questions needed instead of one to obtain the required

information in an unambiguous manner?

3. Do not use double-barreled questions (Do you think that Coca Cola – tasty

fresh soft drink?)

Step 4 Overcoming Inability and Unwillingness to Answer

1. Is the respondent informed?

2. If respondents are not likely to be informed, filter questions

that measure familiarity, product use, and past experience should be asked

before questions about the topics themselves.

3. Can the respondent remember?(Do you remember brand of T-shirt you had last

summer?)

4. Avoid errors of telescoping and creation.

5. Questions which do not provide the respondent with cues can underestimate

the actual occurrence of an event.

6. Can the respondent articulate?

7. Minimize the effort required of the respondents.

8. Is the context in which the questions are asked appropriate

9. Make the request for information seem legitimate.

10.If the information is sensitive:

a. Place sensitive topics at the end of the questionnaire.

b. Preface the question with a statement that the behavior of interest is

common.

(for instance, if you are going to ask about debts on the credit card you

can say, that situation with debts is very common)

c. Ask the question using the third-person technique.

d. Hide the question in a group of other questions which respondents are

willing to answer.

e. Provide response categories rather than asking for specific figures.

f. Use randomized techniques, if appropriate.

Step 5 Choosing Question Structure

1. Open-ended questions are useful in exploratory research and as

opening questions.

2. Use structured questions whenever possible.

3. In multiple-choice questions, the response alternatives should

include the set of all possible choices and should be mutually

exclusive.

4. In a dichotomous question, if a substantial proportion of the

respondents can be expected to be neutral, include a neutral

alternative.

5. Consider the use of the split ballot technique to reduce order

bias in dichotomous and multiple-choice questions.

6. If the response alternatives are numerous, consider using more

than one question to reduce the information processing demands on

the respondents.

Step 6 Choosing Question Wording

1. Define the issue in terms of who, what, when, where, why, and way (the

six Ws).

(What brand of shampoo do you use?)

2. Use ordinary words. Words should match the vocabulary level of the

respondents

(Do you think that distribution of soft drink was organized adequately?)

3. Avoid ambiguous words: usually, normally, frequently, often, regularly,

occasionally, sometimes, etc.

(How often do you visit department store:

-Never; - Seldom; - From time to time; - Often; - Regularly.)

4. Avoid leading questions that clue the respondent to what the answer should

be.

(What do you think: should patriots buy import products? - Yes; - No; - Do

not know.)

5. Avoid implicit alternatives that are not explicitly expressed in the options.

(Do you like to use airlines for short journeys?)

6. Avoid implicit assumptions.

(Do you have positive attitude to the balanced state budget?)

7. Respondent should not have to make generalizations or compute estimates.

(What are the grocery expenses in your family per capita?)

8. Use positive and negative statements.

Step 7 Determine the Order of Questions (Questions sequence)

1. The opening questions should be interesting, simple, and non-threatening.

2. Qualifying questions should serve as the questions at the end (info about

demographic and personal characteristics).

3. Basic information should be obtained first, followed by classification,

and, finally, identification information.

4. Difficult, sensitive, or complex questions should be placed late in the

sequence

5. General questions should precede the specific questions. (Funnel approach)

6. Questions should be asked in a logical order.

7. Branching questions should be designed carefully to cover all possible

contingencies.

8. The question being branched should be placed as close as possible to the

question causing the branching, and (2) the branching questions should be

ordered so that the respondents cannot anticipate what additional information

will be required.

Step 8 Form and Layout

1. Divide a questionnaire into several parts.

2. Questions in each part should be numbered.

3. The questionnaire should be pre-coded.

4. The questionnaires themselves should be numbered serially.

Step 9 Reproduction of the Questionnaire

1. The questionnaire should have a professional appearance.

2. Booklet format should be used for long questionnaires.

3. Each question should be reproduced on a single page (or double-page

spread).

4. Vertical response columns should be used.

5. Grids are useful when there are a number of related questions which use

the same set of response categories.

6. The tendency to crowd questions to make the questionnaire look shorter

should be avoided.

7. Directions or instructions for individual questions should be placed as

close to the questions as possible.

Step 10 Pre-testing

1. Pre-testing should be done always.

2. All aspects of the questionnaire should be tested, including question

content, wording, sequence, form and layout, question difficulty, and

instructions.

3. The respondents in the pretest should be similar to those who will be

included in the actual survey.

4. Begin the pretest by using personal interviews.

5. Pretest should also be conducted by mail or telephone if those methods are

to be used in the actual survey.

6. A variety of interviewers should be used for pretests.

7. The pretest sample size is small, varying from 15 to 30 respondents for

the initial testing.

8. Use protocol analysis and debriefing to identify problems.

9. After each significant revision of the questionnaire, another pretest

should be conducted, using a different sample of respondents. |